Blueprint for Growth: Expand Your Range of Products or Services

Part two of a three-part series…

This post continues our discussion of your “blueprint for growth.” Consider a combination of these possible pathways:

- Growing your core business (organic growth – same services, same territory)

- Expanding your range (more products and services, same territory)

- Expanding your territory (extend your geographic region)

To set actionable goals and measurable milestones for each strategy, you MUST do the math. In my recent post Blueprint for Growth: Grow Your Business, I outlined metrics and analysis to form the blueprint for growing your core business. In this post, I’ll share insights on building the blueprint for expanding your range of products and services.

Expand Your Range of Products or Services

Many franchisors recommend a cadence for adding infrastructure (staff, equipment, facilities) as part of the growth strategy for expanding the range of products or services offered. Assess the opportunities by determining the sales needed to produce your required return on investment (ROI). To do this, you’ll need to know what you must invest up front and how your costs will change in the future.

For example, a sign maker can provide more services to existing customers by adding bigger printing equipment that expands in-house capabilities. A wholesale flooring company may increase revenue by providing kitchen and bath products to their existing construction contractor-customers. Both require up-front investments for equipment or build-out, plus staff to support the ongoing operations and maintenance of the new equipment or facility in the future.

As with the core business (discussed in Part One), a simple breakeven analysis is your friend. This time, instead of using the existing cost structure to set sales targets for the location, you will consider the incremental costs related to the new line. List all the fixed and variable costs related to the opportunity. Then, estimate the variable costs as a percent of sales and the annual fixed costs.

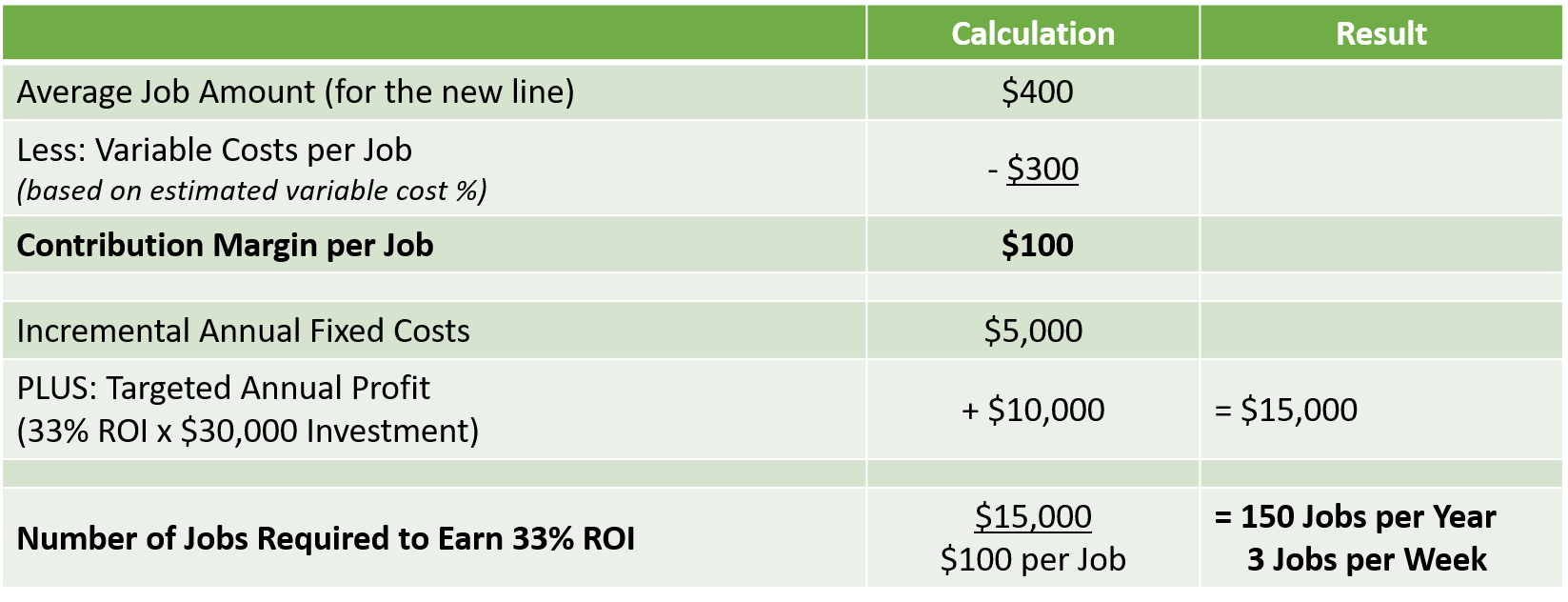

An analysis based on an average customer, job or invoice is extremely useful. Why? Because you can determine the activities needed to earn your targeted ROI.

Example: How many jobs per month would yield a 33% ROI on a $30,000 expansion investment?

At 3 jobs per week this the investment pays for itself in 3 years. Producing more jobs would shorten the payback period. A goal of 3 jobs per week keeps you and your team focused on driving success. On the other hand, hoping you make money on the investment might work. But hope is not a strategy. Do the math!

How Can Advisors and Franchisors Help?

Business advisors and franchisors provide vision and leadership to vet opportunities by selecting a viable range of products and services for expansion. Then they provide guideance so business owners or franchisees know when they are ready to take to the next step. Leadership and vision are essential to successful expansion. Still, many business owners and franchisees lack the education and information needed to make financially sound expansion decisions. Don’t overlook deficiencies of financial acumen or lack of understanding of the most essential metrics for the business.

Financial Education: Provide knowledge, financial skills, and tools. Insure they have numbers they can trust, and they know how to use financial information to make better, more profitable decisions. This includes a solid understanding of the many uses of breakeven analysis, along with basic budgeting and cash flow planning skills. Check out ProfitSoupOnline.com for a quick start, scalable solution to get franchisees on the right financial track, right now (ICFE Education Credits available).

Benchmark your KPIs: Franchise organizations are in a unique position to collect, analyze, and share information. Benchmarking can demonstrate what “good” (and achievable) performance looks like at various phases of unit maturity. Benchmark sales metrics, profitability, and cash flow ratios so franchisees can construct reliable plans and obtain the financing they need to succeed. If your business is not franchised you should be able to get industry benchmarks from your CPA or trade association.

Do the Math

What incremental sales are needed to earn your targeted return on investment? Do the math. Breakeven analysis is an essential skillset for all business leaders. If this seems challenging, invest in yourself first. Take an online course to learn and practice using this essential skill.

In my next post I will detail the blueprint for growth when adding a location.

Need a Tool to Help?

Download our Profit Planning Calculator – a budgeting tool that incorporates Breakeven Analysis in your business planning process.