Many entrepreneurs recall being caught off-guard when pandemic-inspired business interruptions, labor challenges, and supply chain dysfunction wreaked havoc with cost structures. How could you see that coming? Nobody could. Not the case today. Astute planners contemplating their goals and budgets for 2025 are already factoring in how pending National policies could impact their cost structure.

What Does Your Crystal Ball Say?

A few key uncertainties have me wishing for a crystal ball. One that could see through the post-election politicizing of important topics. I’d know how to predict the cost impacts of changing labor policies, possible tariffs, housing supply and demand, and deportations and immigration’s effect on labor supply. Unfortunately, I do not have such a crystal ball, so I will do the next best thing; guess, and hedge my bets by paying attention and staying nimble.

I’m Guessing About Tariffs

Tariffs have the potential to increase the costs of equipment, vehicles, raw materials, supplies, food, and retail merchandise that comes from other countries. Should you accelerate vehicle and equipment purchases, buying now before tariffs become reality? What do you buy regularly that would be affected? Should you stock up? How would you respond if margin drops by 1%, 2%, or 3%? At what point would you raise your prices to pass cost increases on to customers? Will price hikes cause you to lose customers? How long can you afford to absorb the cost increase, waiting for your competitors to go first?

I’m Guessing About Immigration and Exportations

Construction trades are poised for years of profitable growth replenishing a historic housing shortage. The industry depends on an immigrant workforce that is highly skilled and not easy to replace, particularly when unemployment is low. Will labor shortages constrain construction capacity, pushing up home prices – again?

Agriculture and service industries are also at risk when immigrant labor pools shrink. If you haven’t heard farmers’ warnings to expect rising food costs, you haven’t been listening. How will that impact you? Quick service restaurants and fast casual brands can expect higher food costs while their customers feel the pinch of inflation.

A new approach to labor policy could ease the pain. Perhaps the era of sky-rocketing minimum wage rates and costly mandated benefits will end. We can factor that into our budgets, but will it be enough to offset the impact of immigration actions on labor supply?

Will Our Economy be Weak or Strong?

I expect it will continue to be a mixed bag. Economic indicators like unemployment rates, job formation, new business applications, and access to capital point to a strong economy. Some people are doing really well. Yet, high food, fuel, transportation and housing costs are stressing the limits for low-income households. The same economy that is great for the upper-middle class is making it devastatingly impossible for the working poor to improve their standing. Luxury brands may flourish while others feel the pinch of rising food costs and a cost-conscious consumer.

What Can You Do Now?

Lacking a crystal ball, what assumptions will you make for your 2025 margins and labor costs? I don’t know which of these scenarios will materialize, but I’ll be watching closely, and you should too. And I don’t mean CNN or Fox News. I mean watch your cost structure.

Monitor your 5-line P&L and your magic number every month. If you don’t know what I mean by that, check out these Profit Soup resources.

Blog: Plot Your Course to Profits

Blog: Don’t Just React! Anticipate and Prepare for Inflation

Profit Soup Online Series — Breakeven Plus: Your Profit Planning Power Tool

Most of the risks I outlined will show up as higher variable costs as a percentage of sales.

When variable costs go up, contribution margin goes down.

A lower contribution margin requires more volume to earn the same profit.

If tariffs come into play, increasing costs of vehicles and equipment will lift fixed costs.

Higher fixed costs require more volume to earn the same profit.

What Can You Do to Fight the Profit Pinch

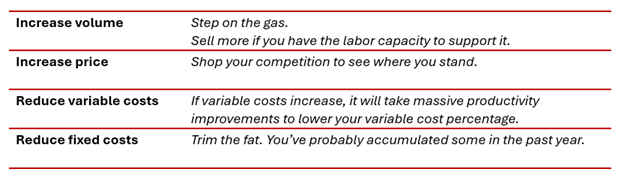

There are four levers you can pull. Everything you can do fits into one of these categories.

What else can you do? See our blog, Prepare for Profits in 2025, Part 2 — 8 Ways to Fight the Profit Pinch.

In Conclusion

- Establish your profit goals – know your profit goal and be prepared to fight for it

- Use the 5-Line P&L to monitor your cost structure every month.

- Get and stay nimble: When rising costs eat into profits, find other pathways to profitability.

- Don’t assume your competitors know what they are doing when it comes to pricing.

- Be on the lookout for opportunities – talent, equipment, markets, locations – get your financial house in order and funding sources lined up so you’re ready to jump when opportunities arise.

More Resources

Ready to start plotting your course to higher profits? These resources can set you on your way.

Business Owners and Managers – Are you a business owner or manager looking to make more profitable decisions for your company? Check out Profit Soup Online, 14 courses, available 24/7, including our most popular series, Breakeven PLUS: Your Profit Planning Power Tool.

Network Managers and Advisors – Bring financial training that sticks to your clients or franchisees. Available via live presentations at your next conference, our acclaimed Profit Soup Online series, and Profit Labs — live cohorts of business owners facilitated by your team. Learn more.