Starting a new business is like entering a race to profit. The goal is to pass breakeven and become consistently profitable before your cash reserves run out. This race has two possible outcomes: winning or losing. Winners make enough profit to keep growing and thriving, while losers run out of cash. There’s no room for “also-rans” in this high-stakes competition.

To win the race, you’ll need an answer to one important question.

How many months will it take to turn a profit?

This is the question every investor should answer. Why? Because this timeline determines how much cash the business will burn and how quickly it will do so.

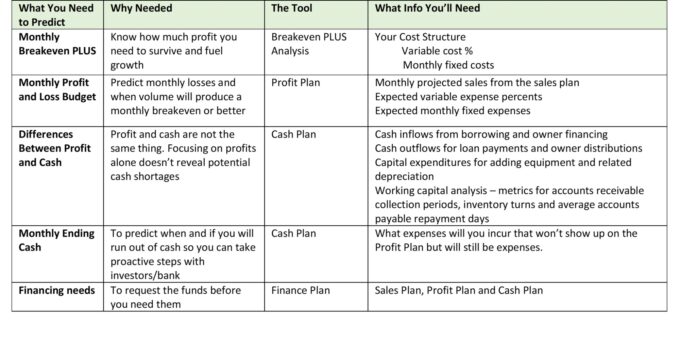

The cash flow needed to win the race to profit is the most difficult financial aspect of a business plan to predict. What’s the solution? You guessed it. Do the math. Build a budget for both profit AND cash because you’ll need both in the long run.

The typical budget shows expected revenue, expenses and profit. It’s your profit plan. Unfortunately you could meet your sales and profit goals and still go out of business if you don’t have enough cash. Your cash flow plan shows how much cash you will burn to keep the enterprise going until and after it becomes profitable.

To mitigate the damage, you’ll need to grow past your breakeven sales as quickly as possible. Winning the race to profit in six months burns less cash and consumes less capital than winning in 12 months.

To answer the question and prepare for the race, entrepreneurs should enter armed with these four things:

- A Sales Plan

- A Profit Plan

- A Cash Flow Plan

- A Financing Plan

The Sales Plan

Sales predictions are the backbone of any startup budget, but how do you figure out what to aim for? Enter breakeven analysis. It’s all about finding two crucial numbers: the sales volume needed to cover your costs (breakeven), and the sales that will generate your desired profit (Breakeven PLUS). Once you have those, plot out the monthly path to Breakeven PLUS.

A Sales Goal is Not a Sales Plan

Sales goals are not enough to drive success. To hit targets, you need to conduct (and measure) activities that bring in customers and increase their purchases. When you’re building a sales plan, it’s not just about the result, but the steps you take to get there.

You’ll need to build a strong customer base and by driving inquiries and converting leads to customer transactions. Upselling and encouraging repeat purchases are also important factors. Your sales plan establishes monthly goals for these activities. You might have goals for these metrics as part of your plan:

Monthly Leads x Converstion Rates = Customer Transactions

Customer Transactions x Average Ticket = Monthly Sales

With activity-based monthly goals like these and process for monitoring actual performance against the goals, you’ll have the process you need to keep your team on track to make your business plan a reality.

Your sales plan might also outline the marketing spend needed to produce the leads. You might have goals for cost per lead, transactions per customer and customer acquisition cost to support the marketing budget. Ongoing, regular analysis of conversions by lead source will help direct future marketing spends in ways that produce the most sales per marketing dollar spent.

Your Profit Plan

The profit plan is like a roadmap for your financial goals. It breaks down the expected revenue, expenses, and profits for each month of the year, giving you a clear picture of what you need to achieve. With this monthly budget in hand, you can regularly compare actual revenues and expenses to the targets. You don’t have to wait until the end of the year (when it may be too late) to assess whether you are on track. Comparing actual results to the budget allows you to adjust your strategy on the fly if things don’t go as planned.

As a serial entrepreneur opening a second unit, you have some secret weapons up your sleeve: experience and actual financial data. But for those just starting out, fear not! Industry benchmarks for revenue, expense percentages and profits are available from various resources such as trade associations or your friendly neighborhood CPA. Risk Management Associates publishes statement studies for many industries. So don’t let financial uncertainty hold you back, arm yourself with solid information and do your due diligence.

Let technology do the heavy lifting for you! Classify your costs as either fixed or variable and input them into your favorite spreadsheet forecasting tool. By recording variable costs as a percentage of sales and fixed costs in dollars, you’ll have the flexibility to change your sales projections and watch your entire budget recalculated in real-time.

Your profit plan shows your monthly profits or losses. By spreadsheeting it monthly over one or two years you can see the impact of growth on monthly and annual profits.

The Cash Flow Plan

Building a business plan takes more than just crunching numbers for sales and profits. Savvy owners know that creating a detailed cash flow plan is crucial for long-term success. By accounting for these common differences between profit and cash, your Profit Plan can be transformed into a comprehensive, cash-focused strategy that assures you have the financial stability to weather the first two years of operation.

- Owner draws – cash outlaws not included owner compensation on the P&L.

- Monthly loan payments – cash outlays that are not on the P&L.

- Depreciation – it’s an expense on the P&L, but it doesn’t require cash.

- Owner capital contributions – these provide cash but are not on the P&L.

- Fixed or intangible asset purchases – they require cash, but are not on the P&L.

- Accounts receivable – credit sales are on the P&L but they don’t provide cash until later, when you collect.

- Accounts payable – credit purchases are on the P&L but don’t use cash until later, when you pay.

- Inventory – purchases consume cash, but the cost of goods sold (not the purchases) is on the P&L. If purchases and cost of goods sold are not the same, inventory levels change which consume cash when inventory grows, and produce cash when inventory is reduced.

Owners who plan to use cash flow of their first location to “fund” a second must be careful. Without a cash flow plan they can find themselves back at the bank asking for an increase in the existing credit limit when pressure from the new (underperforming) location makes it impossible to stay current with bills for the existing (mature and profitable) location(s).

The Cash Flow Plan is the ultimate finance navigator that not only helps to track your monthly cash flow surpluses and deficits but also keeps tabs on your cumulative cash balance. It’s like a crystal ball for your finances, enabling you to anticipate your starting cash reserves and visualize when your profits will replenish your reserves.

The Financing Plan

With growth comes financial needs. It’s important to have a borrowing plan that details how much money you’ll need, when you’ll need it, and how you will pay it back. Many entrepreneurs make the mistake of only planning for long-term financing for equipment and build-out costs of the new business, forgetting about the crucial element of adequate cash flow.

Yes, predicting cash flow can be difficult, but it is necessary to ensure your business stays afloat throughout its race to profit. To truly succeed in expansion, you’ll need a financing plan for both long-term assets and pre-opening costs, as well as a plan for cash flow to support operations until the new unit is “cash positive.”

When mapping out lending terms, match the type of financing with the type of asset. For example, long-term financing should be used to finance assets with a lifespan greater than one year. Short-term credit is for seasonal fluctuations in things that get used up or paid off in less than one year, such as accounts receivable and inventory.

Profit Soup Resources

Cash Flow Planning – Looking to stay ahead of the game? Our Cash Flow Planner is just the tool for you! This handy forecasting tool showcases your monthly cash flow surpluses and deficits, predicting your cumulative cash balance as you go. With its predictive powers, you can easily assess the starting cash reserves necessary for success. Don’t leave your financial future to chance – let our Cash Flow Plan help guide you to fiscal excellence! Download it here!

Breakeven PLUS – Are you looking to master the art of Breakeven PLUS scenarios and revolutionize your business’s profitability? Take your financial skills to the next level with Profit Soup Online’s dynamic and accessible financial training. With our contemporary, on-demand courses, you’ll learn how to make smart, data-driven decisions that will take your business to new heights. Best of all, the first two courses are on us. Don’t miss out on this opportunity to transform the way you do business.

Race to Profit – Hear Profit Soup founder, Barbara Nuss, talk about the Race To Profit on the Small Bites of Business Insights podcast, produced in conjunction with the Yum! Center for Global Franchise Excellence at the University of Louisville.